Business Solar Panel Grants in the UK: What You Need to Know

Last Updated 1 week ago

Commercial Solar

Popular

What solar power for business grants are available in the UK? How can commercial solar panel grants make your investment more affordable?

Table of Contents

If you run a business in the UK, you’re probably feeling the squeeze of rising energy costs and looking for a more predictable way to power your operations. Solar has become one of the most reliable options for doing exactly that; it’s clean, predictable, and increasingly affordable, but there’s usually one stumbling block: the upfront investment.

That’s why having business solar panel grants, tax relief, and energy funding schemes is a dream come true for many businesses in the UK, an answered prayer even. These programs fill the gap by being more than financial lifelines; they’re designed to help companies become more energy independent and sustainable, while cutting operating costs for good, which helps create more resources for these companies to invest in back into themselves and the people that keep them afloat.

National incentives like Full Expensing and Annual Investment Allowance (AIA) deliver instant tax relief, and the Smart Export Guarantee (SEG) lets you earn for sending energy back to the grid. Add to that regional funds, SME loan schemes, and zero-interest public sector programs, and you’ve got multiple pathways to make solar a smart business move in 2026 and beyond.

We put together this blog as a guide, designed to help break it all down, from funding sources and eligibility to how grants can reshape your ROI. Whether you’re a logistics firm in Leicester or a manufacturer in Manchester, you’ll know which programs fit, how to apply, and what to expect once your solar journey begins.

Summary

If you’re thinking about solar power for business use, it’s a good moment to look seriously at it. There’s quite a bit of financial support available in the UK right now, from tax relief to grants and low-interest loans, and these incentives can noticeably reduce the upfront cost of a commercial installation.

In practical terms, businesses can often claim significant tax relief on the system (through Full Expensing or the Annual Investment Allowance), earn money back by exporting unused electricity through the Smart Export Guarantee, and in some regions, access direct grants or 0% financing schemes aimed at helping companies cut energy use and carbon output. The exact support available varies by region and business size, but the effect is the same: lower starting costs and a faster payback period.

Put simply, you’re not paying for the whole system on your own, and these incentives can bring the return on investment forward by several years. If solar has been on your radar, the current funding landscape makes it easier to move from “thinking about it” to actually planning it.

Why Are Solar Grants for Businesses Important?

Every business faces the same question: how do we manage energy costs while staying sustainable? For most, solar ticks every box, but the challenge has always been affordability. That’s why UK business solar panel grants matter so much; they’re not just subsidies but are, in fact, catalysts for modernisation.

Here’s what they help you achieve:

- Lower upfront investment: Grants and tax reliefs can cover 10–40% of total costs.

- Faster ROI: Shorter payback periods mean quicker profitability.

- Carbon accountability: Every funded project supports your sustainability and ESG goals.

- Energy security: Generating your own power stabilises long-term costs.

The UK’s Net Zero Strategy is accelerating corporate support, too, which means more councils and agencies now treat solar as critical infrastructure, not just an environmental upgrade, so basically, more funding routes are opening each year.

What Current Business Solar Panel Grants and Incentives are There in the UK?

Here’s a quick summary of the main commercial solar panel grants and funding mechanisms available in the UK:

Scheme / Grant

Type

Typical Funding

Who Qualifies

Region

Key Benefits

Full Expensing Scheme

Tax Relief

100% first-year capital deduction

All UK businesses

UK-wide

Immediate tax relief on solar costs

Annual Investment Allowance (AIA)

Tax Relief

Up to £1M per tax year

SMEs and large companies

UK-wide

Reduces taxable profits and boosts ROI

Smart Export Guarantee (SEG)

Tariff

5–15p per kWh exported

All system owners

UK-wide

Passive income from surplus energy

Low Carbon Workspace

Grant

Up to £6,750

SMEs

South East England.

Part-funds solar PV and efficiency upgrades

Salix Finance (Public Sector)

Loan

100% interest-free

Schools, NHS, Councils

UK-wide

Covers full installation cost

Scotland SME Loan Scheme

Loan

Up to £100,000 interest-free

Scottish SMEs

Scotland

Supports solar and battery systems

Regional Green Business Grants

Grant

Up to £20,000

SMEs

Regional (e.g. West Midlands, Manchester)

Helps fund carbon-reduction projects

Energy Company Initiatives

Discount / Finance

Varies

Commercial clients

UK-wide

Partner schemes with E.ON, Octopus, etc.

Ready to go Solar ?

How Do You Qualify for Commercial Solar Panel Grants?

Getting your hands on a business solar panel grant isn’t as complicated as it sounds — it’s mostly about showing that your company is serious about sustainability and that your system will make a real impact. Most schemes have similar criteria, so once you meet one, you’re already halfway there for the others.

First off, you’ll need to be a registered UK business, whether that’s a small family-run café, a large manufacturer, or even a nonprofit organisation. The next big box to tick is working with an MCS-certified installer (that’s where we come in). It’s not just a formality; funding bodies want to see your installation meets national standards for safety and performance.

You’ll also need to show how your system will reduce carbon emissions or improve energy efficiency, usually by sharing recent energy consumption data or audit results. Most programs want proof that your solar setup is more than a token gesture, they want measurable change.

Finally, keep in mind that every funding stream comes with its own timeline, typically around 6–12 months from approval to completion, so having a clear project plan in place helps a lot

How Do Business Solar Grants Affect Payback and ROI?

Grants can reshape the economics of your project by offsetting a chunk of the upfront cost; they make your solar system profitable sooner, often by several years.

Here’s how it plays out in real terms:

Scenario

System Cost

Grant / Relief

Payback Period

Annual Savings

No Grant

£60,000

£0

8 years

£8,000/year

With Grant (20%)

£48,000

£12,000

6 years

£8,000/year

With Grant + SEG + AIA

£48,000

£12,000 + Tax & Export

4–5 years

£9,500–£10,000/year

The difference isn’t just financial, it’s strategic. It’s simple, really, businesses with funded solar systems see lower volatility in operational budgets and improved ESG performance, both of which are increasingly valuable for investor and stakeholder confidence.

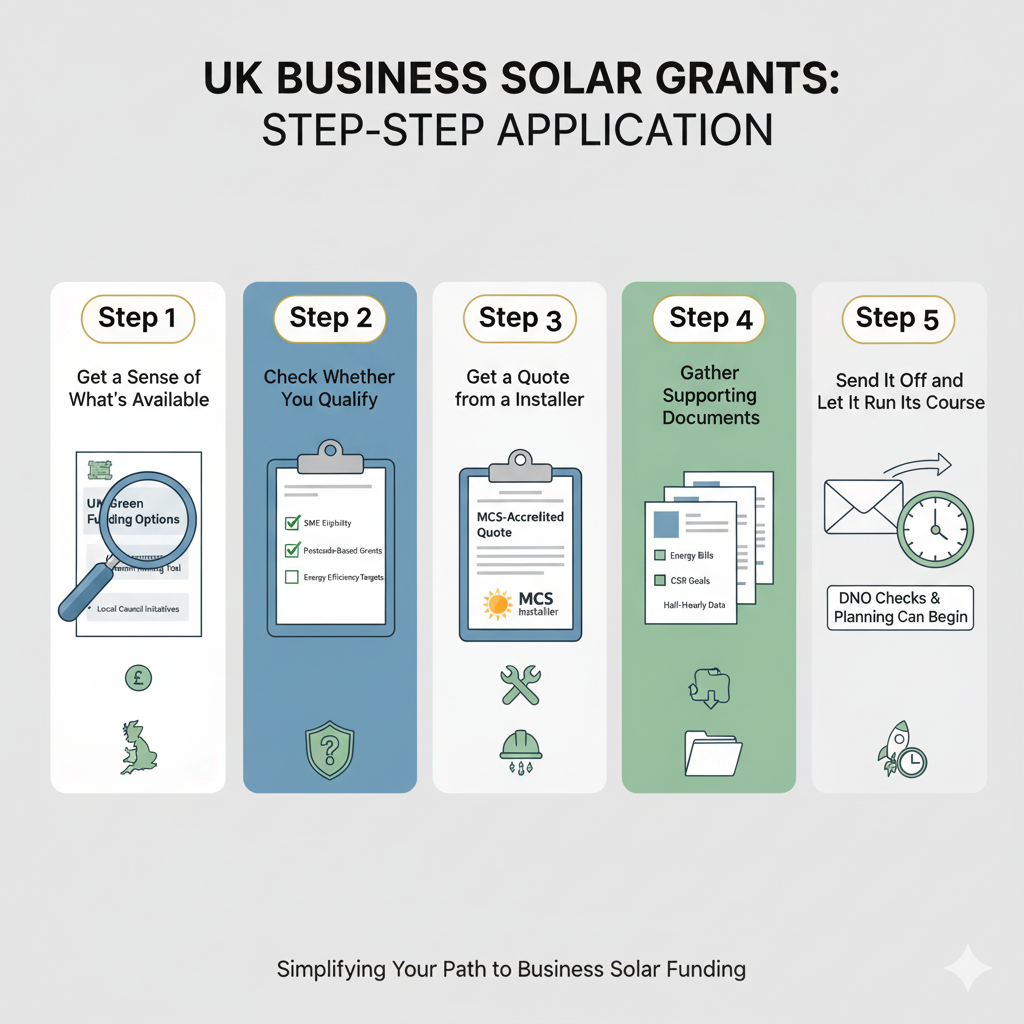

How to Apply for Business Solar Grants in the UK

Applying for solar power for business grants can seem like a bit of admin at first, but once you know the flow, it’s actually pretty simple. Most funding programs follow a similar rhythm: do your research, get your documents in order, and let your installer handle the technical side.

Here’s how to move through it step by step without losing momentum.

Step 1: Get a Sense of What’s Available

Start by having a look at the current funding options. The UK Government’s Green Funding Tool is a good place to begin, and most local councils now list sustainability grants on their websites. It’s worth a quick search; some of the best schemes aren’t widely advertised.

Step 2: Check Whether You Qualify

Every grant has its own conditions. Some are specifically for SMEs, some are postcode-based, and others are open to almost any business as long as the solar system meets efficiency targets. Take a minute to make sure the scheme fits your setup before you move ahead.

Step 3: Get a Quote from a Certified Installer

Nearly all funding applications will ask for an MCS-accredited quote. That’s just to show the system meets UK standards. If you’re working with us at Solar4Good, we’ll put together the design and breakdown you need for the application, so this part is straightforward.

Step 4: Gather a Few Supporting Documents

You’ll usually need to show your current energy usage. Recent electricity bills, half-hourly data (if you have it), and any sustainability or CSR goals your business is working toward all help paint a clearer picture. Think of this as giving the funder context.

Step 5: Send It Off and Let It Run Its Course

Once everything is submitted, there’s a short waiting period, often somewhere between 4 and 10 weeks. While that’s happening, we can get moving on things like DNO checks and initial system planning so you’re not just sitting around waiting.

Bonus tip: If your business operates across more than one location, don’t assume you’re limited to a single grant. Different sites can sometimes qualify for different regional schemes as long as each application meets that area’s requirements.

Ready to go Solar ?

Bottom Line:

Business solar panel grants are no longer rare or overly complex; they’re now one of the UK’s most accessible routes to sustainability and cost savings.

The right funding can cut upfront costs by tens of thousands, boost your long-term ROI, and help your organisation stay ahead of green legislation. With energy prices still unpredictable, it’s one of the few investments that actually reduces your risk over time.

Final Thoughts

Going solar for your business isn’t just about saving on bills; it’s about future-proofing your operations.

At Solar4Good, we handle everything from design and installation to aftercare, ensuring your project meets both technical and regulatory standards. Whether you’re after a small 30 kW rooftop system or a multi-site rollout, our MCS-certified team ensures compliance, quality, and maximum returns. Get in touch today for a free site assessment and funding consultation, and discover how much support your business qualifies for before the next funding window closes.

FAQs

Active programs include Full Expensing, AIA, SEG, Low Carbon Workspace, and various regional green business grants.

Most SMEs and large organisations do, especially if they can demonstrate measurable carbon savings.

Yes. You can stack tax relief, local grants, and SEG income for maximum benefit.

Many do. Battery integration often strengthens your application.

Typically 4–10 weeks, depending on your region and documentation quality.

About the author -

Manan Shah

Leader without Title, Solar4Good

London, United Kingdom

Manan helps homeowners and businesses understand solar with clear, honest advice rooted in real-world experience. He has led national solar education seminars and spoken at major events including Everything Electric Show and The Care Show.